Becoming a lawyer involves several financial considerations. The team at internetlawyers.net understands this, and we’re here to break down the costs of legal education and explore ways to manage them, guiding you through law school expenses and other related fees. Let’s explore the true cost of becoming a legal professional, covering tuition, living expenses, and alternative paths, including financial aid and loan management, which are essential for a career in law.

1. What is the Average Cost of Law School?

The average total cost of law school in the United States is approximately $230,163, encompassing tuition and living expenses. This significant investment covers three years of study, but can vary widely depending on the institution you choose. Let’s break down these costs further.

- Tuition: The average tuition cost for law school is around $151,072, which averages to about $50,357 per year. However, this number can fluctuate significantly between public and private institutions. For example, Columbia University has an annual tuition of $81,292, while the University of Puerto Rico is significantly lower at $9,750 per year.

- Living Expenses: Living expenses average about $79,391, or $24,464 annually. This includes housing, food, transportation, and other personal expenses. These costs can vary widely depending on the location of the law school. For instance, Stanford University has an annual living expense of $47,832, while Oklahoma City University has a much lower cost at $12,600 annually.

Cost to become a lawyer, breaking down average law school expenses by Education Data Initiative

Cost to become a lawyer, breaking down average law school expenses by Education Data Initiative

2. How Does Tuition Cost Vary Among Law Schools?

Tuition costs can vary significantly depending on whether you attend a public or private law school, and whether you are an in-state or out-of-state resident. Public schools generally offer lower tuition rates for in-state residents, while private schools tend to have similar tuition rates for all students, regardless of residency.

| School Type | Average Annual Tuition Cost |

|---|---|

| Public (In-State) | $25,000 – $45,000 |

| Public (Out-of-State) | $40,000 – $60,000 |

| Private | $50,000 – $80,000 |

As you can see, the cost of law school can be significantly reduced by attending a public school in your state of residence. According to EducationData.org, the tuition gap between public and private schools can reach up to $75,417 over the traditional three-year program.

3. What are Some of the Most and Least Expensive Law Schools?

To provide a clearer picture of the range in tuition costs, let’s look at some specific examples of the most and least expensive law schools in the U.S., based on annual tuition costs:

Most Expensive Law Schools:

| Law School | Annual Tuition Cost |

|---|---|

| Columbia University | $81,292 |

| New York University | $80,014 |

| Cornell University | $77,593 |

| University of Chicago | $77,952 |

| University of Pennsylvania | $76,934 |

Least Expensive Law Schools:

| Law School | Annual Tuition Cost |

|---|---|

| University of Puerto Rico | $9,750 |

| Inter American University | $15,635 |

| Pontifical Catholic University of Puerto Rico | $16,608 |

| Southern Illinois University | $21,555 |

| Northern Illinois University | $23,553 |

These figures highlight the substantial financial commitment required for law school, but also show that there are more affordable options available.

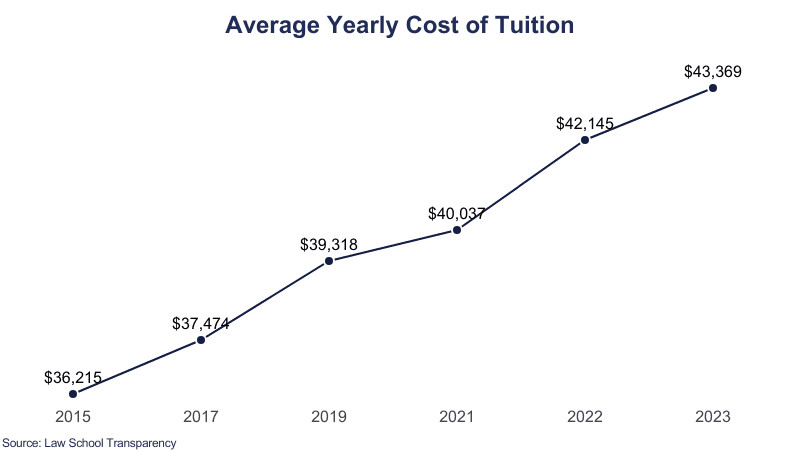

4. How Have Law School Tuition Costs Changed Over Time?

Law school tuition costs have been steadily increasing over the years. Since the 1970s, historical data indicates that tuition has risen at all ABA-accredited law schools.

- Historical Trends: Since 2011, the average cost of tuition has increased by approximately $4,867 every five years. Experts attribute this rise to various factors, including declines in student-faculty ratios, increases in faculty salaries, the development of legal clinics for practical education, the growth of administrative staff, and expansive school construction projects.

- Future Projections: On its current trend, the average yearly cost of tuition is projected to be $51,193 for the 2024-2025 school year, and $53,230 for the 2025-2026 school year.

- Case Studies: From 1997 to 2015, the rate of tuition at Minnesota Law School rose from $8,923 to $41,222, while at Ohio State Law School, it increased from $6,412 to $28,577.

5. What are the Additional Costs Associated with Becoming a Lawyer?

Besides tuition and living expenses, several additional costs are associated with becoming a lawyer. These can add up and should be factored into your financial planning:

- Law School Application Fees: Each law school application typically costs around $80. The average applicant applies to between 5 and 15 law schools, resulting in total application fees ranging from $400 to $1,200.

- Bar Exam Fees: After completing law school, graduates must take the bar exam to obtain their practicing license. The average cost of a multi-state bar exam is projected to be $160 in 2024, an increase from $150 in 2023.

- Bar Review Courses: Preparing for the bar exam often involves enrolling in a bar review course, which can cost between $1,000 and $4,000, depending on the provider and format (e.g., online, in-person).

- Licensing and Admission Fees: Once you pass the bar exam, you’ll need to pay licensing and admission fees to the state bar, which can range from a few hundred to over a thousand dollars.

6. What are Alternative Degrees to a Juris Doctor (J.D.)?

For those seeking to work in the legal field without becoming lawyers, alternative degrees offer shorter and more affordable programs. These degrees may include a Juris Master (J.M.) or a Master of Legal Studies (M.L.S.).

- Juris Master (J.M.): A J.M. typically lasts one to two years and provides a foundation in legal principles without qualifying graduates to practice law. For example, a J.M. from Florida International University is a one-year program costing $24,726, while a J.M. from Liberty University School of Law costs $16,950 in tuition for the entire program.

- Master of Legal Studies (M.L.S.): Many M.L.S. degrees are available online and can be completed within one to two years. These programs are designed for professionals in various fields who need a working knowledge of the law. The University of Oklahoma’s M.L.S. degrees typically cost $16,995 for residents and $30,840 for non-residents. Seattle University School of Law’s M.L.S. degree costs $43,860, regardless of residency.

7. What Financial Aid Options are Available for Law School?

Navigating the costs of law school can be daunting, but various financial aid options are available to help students manage their expenses. These include scholarships, grants, and loans.

- Scholarships: Law schools and external organizations offer scholarships based on merit, need, and specific criteria. These can significantly reduce the overall cost of tuition.

- Grants: Grants are typically need-based and do not need to be repaid. These can come from federal, state, or institutional sources.

- Loans: Federal and private loans are common ways to finance law school. Federal loans often have lower interest rates and more flexible repayment options than private loans.

It’s important to research and apply for as many scholarships and grants as possible to minimize the amount you need to borrow.

8. What are Conditional Scholarships and How Common are They?

Conditional scholarships are awarded to students based on maintaining a certain grade point average (GPA) or class standing. However, these scholarships have become less popular over the years.

- Trends: From 2011 to 2012, approximately 61.4% of law schools offered conditional scholarships. By 2022 to 2023, this number had decreased to roughly 36.7%.

- Loss Rates: The percentage of students who lost their conditional scholarships also decreased, from 36.1% in 2011-2012 to 26.5% in 2022-2023.

While conditional scholarships can be helpful, it’s crucial to understand the requirements and potential risks involved.

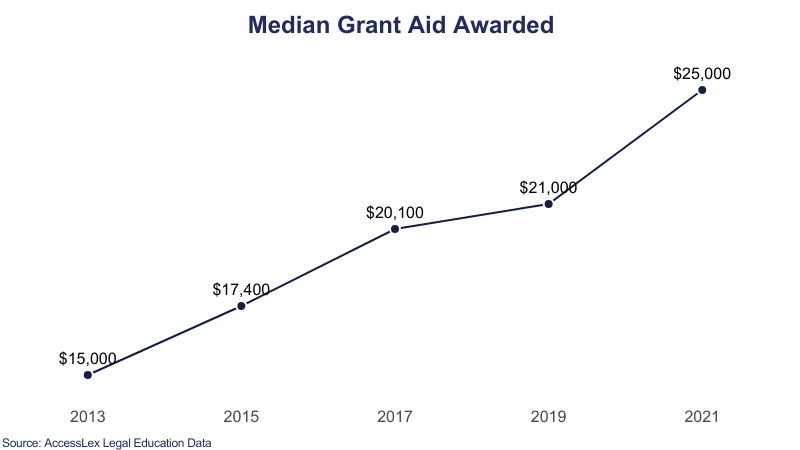

9. What is the Trend in Median Grant Aid for Law School Students?

The median grant aid awarded to law school students has increased over time, providing more financial support to those pursuing legal education.

- Historical Data: From 2012 to 2013, the median grant aid for law school was $13,500. Between 2013 and 2021, the median grant aid awarded to full-time students increased by $7,500.

- Institutional Grants: In 2018, 6% of law school students received institutional grants covering the full cost of their tuition, while 28% received grants covering at least half the cost.

Law school median grant aid awarded over time, detailed by Education Data Initiative

Law school median grant aid awarded over time, detailed by Education Data Initiative

10. How Much Debt Do Law School Graduates Typically Have?

Many law school graduates rely on loans to finance their education, leading to significant debt.

- Debt Statistics: According to EducationData.org, 69% of law school graduates took out loans in 2016 and acquired debt. The average cumulative debt held by those who completed law degrees in 2016 was $145,500.

Managing this debt requires careful planning and consideration of repayment options.

11. What are Some Strategies for Managing Law School Debt?

Given the high levels of debt that many law school graduates face, it’s essential to have strategies for managing and repaying these loans effectively.

- Budgeting: Create a detailed budget to track your income and expenses, and identify areas where you can cut back to allocate more funds towards loan repayment.

- Loan Consolidation: Consider consolidating your federal loans to simplify repayment and potentially lower your interest rate.

- Income-Driven Repayment Plans: Federal loans offer income-driven repayment plans, which base your monthly payments on your income and family size. These plans can make loan repayment more manageable, especially in the early years of your career.

- Public Service Loan Forgiveness (PSLF): If you work in a qualifying public service job, you may be eligible for PSLF, which forgives the remaining balance on your federal loans after you’ve made 120 qualifying payments.

- Refinancing: If you have good credit, you may be able to refinance your loans with a private lender to secure a lower interest rate.

12. What is the Cost of Living in Different Law School Locations?

The cost of living can vary significantly depending on the location of your law school, which can impact your overall expenses.

- Urban vs. Rural: Urban areas generally have higher living costs than rural areas, including housing, transportation, and everyday expenses.

- Regional Differences: The cost of living can also vary between different regions of the country. For example, the Northeast and West Coast tend to be more expensive than the Midwest and South.

Here’s a comparison of annual living expenses in different law school locations:

| Law School | Annual Living Expenses |

|---|---|

| Stanford University | $47,832 |

| Columbia University | $32,419 |

| University of California – Berkeley | $43,198 |

| Oklahoma City University | $12,600 |

| University of Missouri – Columbia | $19,184 |

13. How Can I Create a Budget for Law School?

Creating a budget for law school is crucial for managing your finances and minimizing debt. Here are some steps to create an effective budget:

- Calculate Your Income: Determine all sources of income, including loans, scholarships, grants, savings, and any part-time work.

- Track Your Expenses: Monitor your spending for a month to understand where your money is going. Categorize your expenses into fixed costs (e.g., rent, tuition) and variable costs (e.g., food, entertainment).

- Set Realistic Limits: Set spending limits for each category based on your income and financial goals.

- Use Budgeting Tools: Utilize budgeting apps or spreadsheets to track your progress and make adjustments as needed.

- Review and Adjust: Regularly review your budget to ensure it aligns with your financial situation and make necessary adjustments.

14. What Resources are Available for Law School Financial Planning?

Several resources are available to help you plan and manage your law school finances:

- Law School Financial Aid Offices: Your law school’s financial aid office can provide information on scholarships, grants, loans, and budgeting.

- American Bar Association (ABA): The ABA offers resources on financial aid, debt management, and career planning for law students.

- EducationData.org: Provides data and insights on the costs of higher education, including law school.

- Federal Student Aid: The U.S. Department of Education’s website offers information on federal student loans and repayment options.

- Financial Aid Websites: Websites like Sallie Mae and Peterson’s offer tools and resources for financial aid planning.

15. How Does the Cost of Law School Compare to Other Graduate Programs?

The cost of law school is comparable to other graduate programs, but it tends to be higher than many master’s degrees.

- Medical School: The average total cost of medical school is similar to law school, often ranging from $200,000 to $300,000.

- MBA Programs: MBA programs at top business schools can also be expensive, with total costs ranging from $100,000 to $200,000.

- Master’s Degrees: Master’s degrees in fields like education, social work, or the humanities generally cost less than law school, often ranging from $30,000 to $80,000.

Here’s a comparison table:

| Degree | Average Total Cost |

|---|---|

| Juris Doctor (J.D.) | $230,163 |

| Medical Doctor (M.D.) | $200,000 – $300,000 |

| Master of Business Administration (MBA) | $100,000 – $200,000 |

| Master of Arts (M.A.) | $30,000 – $80,000 |

16. How Can I Reduce My Law School Expenses?

There are several strategies to reduce your law school expenses:

- Attend a Public Law School: Public law schools generally offer lower tuition rates for in-state residents.

- Live Frugally: Minimize your living expenses by finding affordable housing, cooking meals at home, and cutting back on non-essential spending.

- Buy Used Textbooks: Purchase used textbooks or rent them to save money on course materials.

- Seek Financial Aid: Apply for scholarships, grants, and federal loans to reduce the amount you need to pay out of pocket.

- Work Part-Time: If possible, work part-time to earn income and offset some of your expenses.

17. What are the Long-Term Financial Benefits of Becoming a Lawyer?

Despite the high costs of law school, becoming a lawyer can offer significant long-term financial benefits.

- Earning Potential: Lawyers typically earn higher salaries than many other professionals. According to the U.S. Bureau of Labor Statistics, the median annual wage for lawyers was $127,990 in May 2021.

- Career Advancement: A law degree can open doors to various career opportunities in law firms, government agencies, corporations, and non-profit organizations.

- Job Security: Lawyers are generally in demand, and their skills are valuable in various industries.

- Entrepreneurial Opportunities: With a law degree, you can start your own law firm or consulting business, offering the potential for higher income and greater autonomy.

18. How Does Law School Cost Affect Career Choices?

The cost of law school can influence your career choices after graduation. High debt levels may lead you to seek higher-paying jobs in corporate law or large law firms to repay your loans more quickly.

- Public Interest vs. Private Sector: Graduates with significant debt may be less likely to pursue lower-paying public interest jobs, even if they are passionate about those fields.

- Geographic Location: Debt can also influence where you choose to practice law. Larger cities with higher salaries may be more attractive to those with substantial student loan debt.

It’s important to consider your financial goals and career aspirations when deciding which path to take after law school.

19. What Role Does Networking Play in Securing Financial Aid and Job Opportunities?

Networking can play a crucial role in securing financial aid and job opportunities in the legal field.

- Scholarships and Grants: Networking with alumni, professors, and other legal professionals can help you learn about scholarship and grant opportunities.

- Internships and Clerkships: Networking can lead to valuable internships and clerkships, which can provide experience and potential job offers.

- Job Opportunities: Building relationships with lawyers and legal professionals can open doors to job opportunities that may not be advertised.

Attend law school events, join professional organizations, and connect with people in your field to expand your network and increase your chances of success.

20. What are the Ethical Considerations When Borrowing for Law School?

When borrowing for law school, it’s important to consider the ethical implications of taking on significant debt.

- Responsible Borrowing: Borrow only what you need and avoid taking on more debt than you can reasonably repay.

- Financial Literacy: Understand the terms of your loans and repayment options to make informed decisions.

- Transparency: Be transparent with your lender about your financial situation and any challenges you face.

- Professional Obligations: Consider the impact of your debt on your ability to serve your clients and uphold your professional responsibilities.

Making informed and ethical decisions about borrowing for law school can help you achieve your career goals while maintaining financial stability.

Are you ready to embark on your journey to becoming a lawyer? At internetlawyers.net, we understand the financial commitment involved and are here to provide you with the resources and support you need. From understanding tuition costs to exploring financial aid options and managing debt, we’ve got you covered. Visit internetlawyers.net today to access valuable information, connect with experienced legal professionals, and take the first step towards a successful and fulfilling legal career. Address: 111 Broadway, New York, NY 10006, United States. Phone: +1 (212) 555-1212.