When your property is damaged, whether it’s your home or business, dealing with the aftermath can be overwhelming. From assessing the damage to filing an insurance claim, the process can quickly become complex, especially when you feel your insurance company isn’t offering a fair settlement. This is where a Property Damage Insurance Claim Lawyer becomes an invaluable ally.

But what exactly does a property damage insurance claim lawyer do? And when should you consider seeking their help? Let’s break down the essentials to ensure you understand your rights and how to navigate the claims process effectively, maximizing your chances of receiving the compensation you deserve.

Infographic illustrating different types of lawyers for property damage and their expertise. – what kind of lawyer do i need for property damage infographic pillar-3-steps

Infographic illustrating different types of lawyers for property damage and their expertise. – what kind of lawyer do i need for property damage infographic pillar-3-steps

Understanding Property Damage and Insurance Claims

Before diving into the role of a property damage insurance claim lawyer, it’s crucial to understand what constitutes property damage and how insurance policies are designed to protect you.

Defining Property Damage: Real, Personal, and Tangible Property

Property damage refers to the destruction or harm inflicted upon your property due to various events. It’s important to differentiate between types of property, as this impacts insurance coverage and claim processing.

Real Property encompasses land and anything permanently attached to it. This includes buildings, houses, garages, and fixtures that are considered part of the land.

Personal Property, conversely, includes movable possessions not fixed to the land. Think of furniture, electronics, vehicles, clothing, and jewelry. These are items that you can take with you if you move.

Both real and personal property fall under the category of tangible property. This means they are physical assets you can touch and feel, distinguishing them from intangible assets like stocks or intellectual property. Insurance policies and legal frameworks treat tangible property differently than intangible assets.

The Crucial Role of Insurance Policies in Property Damage

Insurance policies are your financial safety net when property damage occurs. They are contracts designed to protect you from financial losses resulting from unforeseen events. Coverage can extend to both real and personal property, but the specifics are defined by your policy.

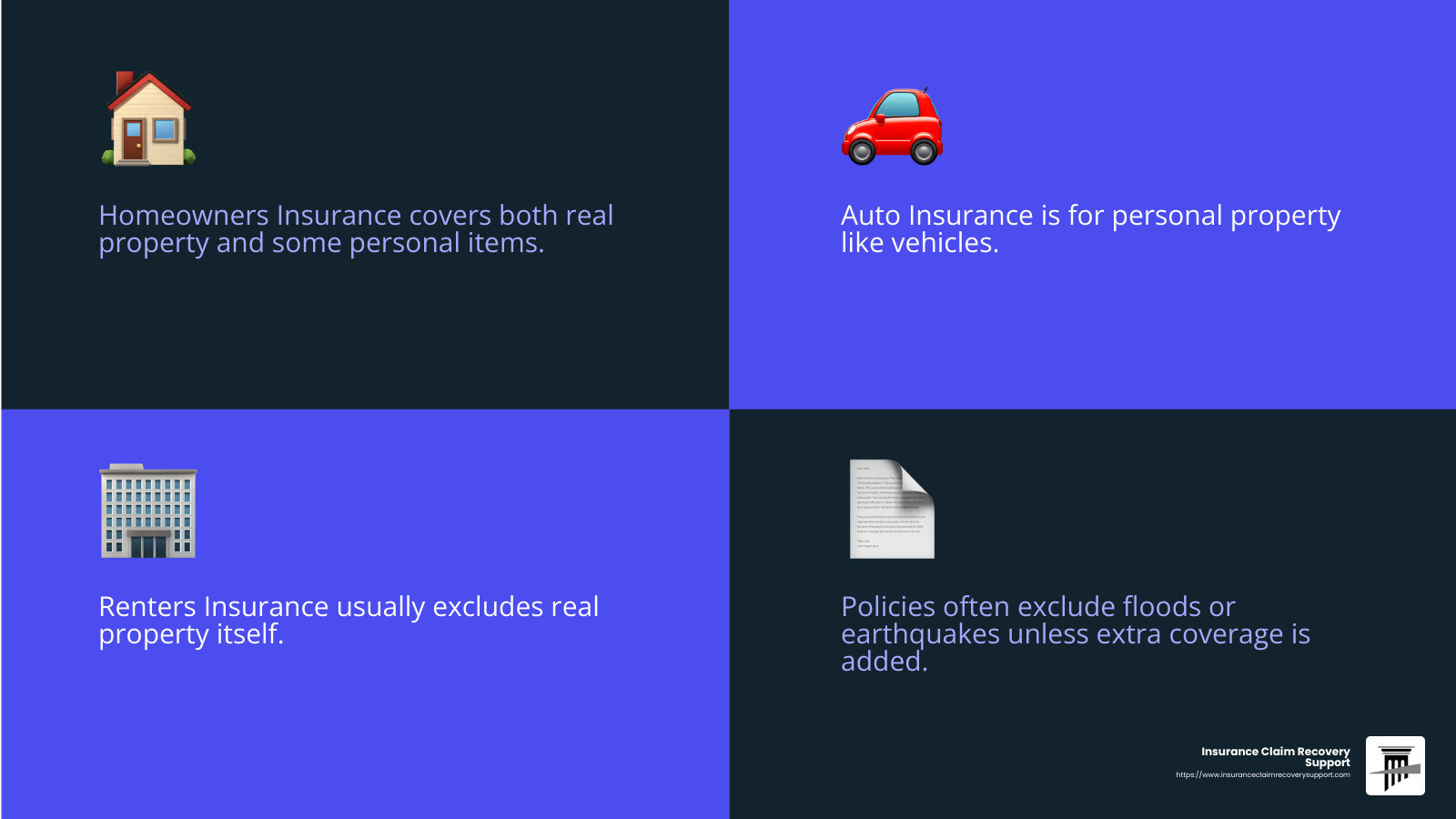

Different types of insurance policies cater to different needs:

- Homeowners Insurance: This is designed to protect your residence (real property) and often includes coverage for personal property within your home.

- Auto Insurance: Specifically covers vehicles (personal property) against damage from accidents, theft, and other covered perils.

- Renters Insurance: Protects your personal property within a rented residence. It typically doesn’t cover the structure itself (real property), which is the landlord’s responsibility.

- Commercial Property Insurance: Tailored for businesses, covering commercial buildings (real property) and business personal property like equipment and inventory.

Each insurance policy is unique, outlining specific terms, conditions, coverages, and exclusions. Standard policies often exclude certain types of damage, such as flood or earthquake damage, requiring separate, additional coverage endorsements.

Reviewing your insurance policy meticulously after property damage is paramount. This review will clarify what damages are covered and guide you in the claim filing process. When disputes arise with your insurer, understanding your policy and knowing when to consult a property damage insurance claim lawyer can be crucial for navigating complexities and securing fair compensation.

Understanding insurance policies is crucial to navigating property damage claims. – what kind of lawyer do i need for property damage infographic 4_facts_emoji_blue

Understanding insurance policies is crucial to navigating property damage claims. – what kind of lawyer do i need for property damage infographic 4_facts_emoji_blue

Common Causes of Property Damage: Understanding the Risks

Property damage can stem from a wide range of events. Understanding these common causes can help you prepare, respond effectively, and navigate insurance claims more smoothly.

-

Natural Disasters: These are significant contributors to property damage. Events like hurricanes, earthquakes, floods, wildfires, and severe storms (hail, wind) can cause widespread destruction to both residential and commercial properties. For example, coastal areas are prone to hurricane damage, while regions with cold winters might experience damage from frozen and burst pipes.

-

Human Error: Accidents resulting from human mistakes are another frequent cause. This could range from a contractor’s error during renovations leading to water damage, to a vehicle collision impacting your building. Even seemingly small errors can result in substantial property damage and subsequent insurance claims. Statistics show a significant percentage of insured homes file a claim annually, highlighting the prevalence of such incidents.

-

Construction Defects: Faulty workmanship or substandard materials used during construction can lead to both immediate and long-term property damage. Issues like foundation problems, roof leaks due to poor installation, or structural weaknesses can emerge, causing significant repair costs. If negligence or poor construction is identified as the cause, the responsible parties, such as contractors or developers, may be liable for the damages.

-

Vandalism and Criminal Acts: Intentional acts of destruction, such as vandalism, burglary, or arson, can result in considerable property damage. This can range from graffiti and broken windows to more severe structural damage. Businesses and homeowners often implement security measures to deter such acts. Insurance policies generally cover vandalism, but it’s important to review your specific policy details and coverage limits.

Understanding these common causes underscores the importance of adequate insurance coverage and being prepared to handle property damage incidents. Knowing when and how a property damage insurance claim lawyer can assist you in these situations is equally crucial.

When Do You Need a Property Damage Insurance Claim Lawyer?

Navigating the aftermath of property damage can be daunting, particularly when dealing with insurance claims. Knowing when to seek legal counsel from a property damage insurance claim lawyer is essential to protect your rights and financial interests.

Scenarios That Warrant Legal Representation

-

Insurance Claim Denials: Perhaps the most critical time to hire a lawyer is when your insurance company denies your legitimate property damage claim. Insurers might deny claims for various reasons, some valid, some not. A lawyer can scrutinize the denial, assess its legitimacy based on your policy and the circumstances, and fight for your rightful coverage.

-

Underpaid Claims: Even if your claim isn’t outright denied, you might receive a settlement offer that is significantly less than the actual cost to repair or replace your damaged property. Insurance companies may attempt to minimize payouts. A property damage insurance claim lawyer can evaluate the true extent of your damages, negotiate with the insurer, and challenge underpaid settlements to ensure you receive fair compensation.

-

Claim Delays: Unreasonable delays in processing your claim can add financial and emotional stress. Insurance companies have a duty to handle claims in a timely manner. If your claim is stalled without valid reasons, a lawyer can intervene to expedite the process and hold the insurer accountable.

-

Complex Claims and Disputes: Some property damage claims are inherently complex, involving significant damage, intricate policy language, or disputes over the cause of damage. Situations involving commercial property damage, extensive losses, or disagreements about policy interpretation often benefit from legal expertise.

-

Bad Faith Insurance Practices: Insurers are expected to act in “good faith” when handling claims. Bad faith practices include unreasonable claim denials, delays, or underpayments, misrepresenting policy terms, or failing to conduct a proper investigation. If you suspect bad faith insurance practices, a property damage insurance claim lawyer is crucial to protect you from unfair treatment and pursue legal remedies.

-

Legal Deadlines (Statute of Limitations): There are strict legal time limits for filing property damage lawsuits, known as the statute of limitations. Missing these deadlines can permanently bar your right to sue. A lawyer is aware of these deadlines and will ensure your claim is filed promptly and correctly within the legal timeframe.

How a Property Damage Insurance Claim Lawyer Advocates For You

A skilled property damage insurance claim lawyer brings significant expertise to the table, acting as your advocate throughout the claims process.

-

Case Evaluation and Policy Review: A lawyer will thoroughly assess your situation, starting with a detailed review of your insurance policy. They will interpret the policy language, identify applicable coverages, and evaluate the strengths and weaknesses of your claim. This step is crucial in determining the best course of action.

-

Damage Assessment and Documentation: Lawyers often work with experts to accurately assess the full extent of your property damage. This may involve independent adjusters, contractors, engineers, or other professionals who can provide detailed evaluations and documentation to support your claim. Proper documentation is key to maximizing your settlement.

-

Negotiation with Insurance Companies: Negotiation is a core skill of a property damage insurance claim lawyer. They act as your intermediary, communicating and negotiating directly with insurance adjusters. Lawyers are adept at countering insurance company tactics, presenting compelling arguments for fair settlement, and protecting your interests during negotiations.

-

Litigation and Lawsuit Filing: If negotiations fail to yield a fair settlement, or if the insurance company acts in bad faith, a lawyer is prepared to take your case to court. They will handle all aspects of litigation, including filing lawsuits, gathering evidence, conducting discovery, and representing you in court proceedings. Litigation is a powerful tool to compel insurers to honor their policy obligations.

-

Understanding Legal and Insurance Nuances: Property damage law and insurance policies are complex areas. Lawyers specializing in this field possess in-depth knowledge of relevant laws, regulations, and insurance industry practices. This expertise allows them to effectively navigate legal and procedural hurdles, advocate for your rights, and build a strong case on your behalf.

Essential Steps to Take After Discovering Property Damage

Taking swift and correct actions immediately after discovering property damage is critical to protecting your property and ensuring a smoother insurance claim process.

Immediate Actions to Protect Your Property and Claim

-

Mitigate Further Damage: Your first responsibility is to prevent the damage from worsening. Take reasonable steps to protect your property from further harm. For example, if you have a burst pipe, immediately turn off the water supply. Cover damaged roofs or windows to prevent further weather exposure. Document your mitigation efforts, as insurers expect policyholders to take reasonable steps to minimize losses.

-

Thorough Documentation: Meticulous documentation is paramount for a successful insurance claim. Take detailed photographs and videos of all damaged areas. Capture the damage from various angles and distances. Create a written inventory of damaged personal property, if applicable. Preserve any damaged items as evidence until your insurance adjuster advises otherwise.

-

Report to Authorities if Necessary: If the property damage is due to a crime like vandalism or theft, file a police report immediately. A police report provides official documentation of the incident and can be crucial for your insurance claim.

-

Contact Your Insurance Company Promptly: Notify your insurance company as soon as reasonably possible after discovering the damage. Most policies have clauses requiring timely reporting. Provide them with initial details of the incident, the type of damage, and your policy information.

Navigating the Insurance Claim Process

-

Filing the Claim: Follow your insurance company’s procedure for formally filing a claim. This usually involves submitting a claim form and providing the documentation you’ve gathered (photos, videos, inventory, police report, etc.).

-

Working with the Insurance Adjuster: The insurance company will assign an adjuster to evaluate your claim. Cooperate with the adjuster, provide them with all requested information, and allow them to inspect the damage. However, remember that the adjuster represents the insurance company’s interests. It’s wise to keep detailed records of all communications with the adjuster.

-

Obtaining Repair Estimates: Get multiple independent repair estimates from reputable contractors for the necessary repairs. These estimates will help you understand the fair cost of repairs and provide a basis for negotiating with the insurance adjuster.

-

Reviewing the Settlement Offer: Once the adjuster completes their evaluation, the insurance company will issue a settlement offer. Carefully review this offer and compare it to your repair estimates and policy coverage. If the offer seems inadequate, do not accept it immediately.

When Legal Action Might Be Necessary

-

Disputing Claim Denials or Underpayments: If you believe your claim was unfairly denied or the settlement offer is insufficient to cover your losses, you have the right to dispute the insurance company’s decision. This is where a property damage insurance claim lawyer can be invaluable.

-

Third-Party Liability Claims: If the property damage was caused by the negligence or actions of a third party (e.g., a contractor, neighbor, or another entity), you may need to pursue a claim against that party in addition to or instead of your insurance claim. A lawyer can help you assess liability and pursue a third-party claim.

-

Breach of Contract Lawsuits: If your insurance company fails to honor the terms of your policy and acts in bad faith, legal action in the form of a breach of contract lawsuit may be necessary to compel them to fulfill their contractual obligations and provide fair compensation.

Frequently Asked Questions About Property Damage Insurance Claim Lawyers

Understanding the legal aspects of property damage claims often raises numerous questions. Here are answers to some frequently asked questions about property damage insurance claim lawyers:

How do I initiate a lawsuit for property damage?

To sue for property damage, you typically begin by filing a notice of claim with the responsible party. This formal document outlines your intention to seek compensation for the damages incurred and provides details about the incident and the damages.

Following the notice of claim, you would file a lawsuit in the appropriate court. This involves submitting legal documents that formally initiate the legal proceedings. It’s crucial to adhere to proper legal procedures and deadlines when filing a lawsuit. Consulting with a property damage insurance claim lawyer is highly recommended to ensure all steps are taken correctly.

What is the timeframe for filing a property damage claim?

The statute of limitations dictates the time limit within which you must file a lawsuit for property damage. This timeframe varies by jurisdiction but is commonly around three years from the date the damage occurred. Missing this deadline generally means forfeiting your right to sue for damages.

Certain exceptions can extend the statute of limitations, such as if the responsible party is out of state or conceals their identity, or if the property owner is legally incapacitated (e.g., a minor). It’s essential to consult with a lawyer to determine the specific statute of limitations in your jurisdiction and any applicable exceptions.

What recourse do I have if my insurance claim is rejected?

If your insurance carrier denies your property damage claim, you have options. Dispute resolution is the initial step. This often involves formally appealing the denial to the insurance company, providing additional documentation or evidence to support your claim, and attempting to negotiate a resolution.

If the dispute resolution process is unsuccessful, legal action may be necessary. This could involve suing the insurance company for breach of contract, especially if you believe the denial was unjustified and violates the terms of your policy. A property damage insurance claim lawyer can guide you through these dispute and legal processes, increasing your chances of overturning a wrongful claim denial and obtaining fair compensation.

Conclusion: Your Advocate for Fair Property Damage Compensation

Navigating property damage insurance claims can be a complex and frustrating experience. When faced with denied claims, underpaid settlements, or bad faith insurance practices, a property damage insurance claim lawyer is your essential advocate.

A dedicated lawyer brings expertise in insurance law, negotiation skills, and litigation experience to fight for your rights and ensure you receive the full compensation you deserve to repair or replace your damaged property. Don’t navigate the claims process alone – seeking legal counsel can significantly improve your outcome and provide peace of mind during a challenging time. If you’re struggling with a property damage insurance claim, consider consulting with a qualified attorney to explore your options and protect your financial future.