The COVID-19 pandemic has profoundly impacted nearly every sector globally, and Real Estate Investment Trusts (REITs) are no exception. The ensuing economic downturn has significantly dampened demand across most real estate sectors, leading to considerable price declines in the first half of 2020. As of June 30th, the FTSE Nareit All REITs Index reported a year-to-date total return of -15.01%. Interestingly, this downturn has pushed the average dividend yield to 4.33%, up from 4.06% in 2019. This raises critical questions for investors: Does this indicate further losses, or is it presenting a unique buying opportunity in the REIT market? Let’s delve into the current context and explore the path forward for REIT investments.

COVID and the Stock Market

COVID and the Stock Market

The Strain on Rent Collections

The fundamental challenge for REITs during the pandemic lies in rent collections. Widespread business closures and job losses directly translate to tenants’ inability to pay rent. Given that REITs rely heavily on rental income, the impact of the pandemic is immediately apparent. Unemployment surged to levels unseen since the Great Depression of the 1930s, causing a domino effect: rent collections dwindle, property values decrease, demand for leases weakens, and new construction projects decelerate.

For some REITs, particularly those with less robust financial structures, the primary concern is maintaining solvency. Significant recovery within the real estate sector is unlikely to materialize fully until a widely accessible COVID-19 vaccine becomes available. However, waiting for complete certainty might mean missing out on the early stages of recovery. Many financial advisors suggest that investors should consider holding or even increasing their REIT positions, strategically weathering the current economic storm to capitalize on the eventual rebound.

Divergent Sector Performance

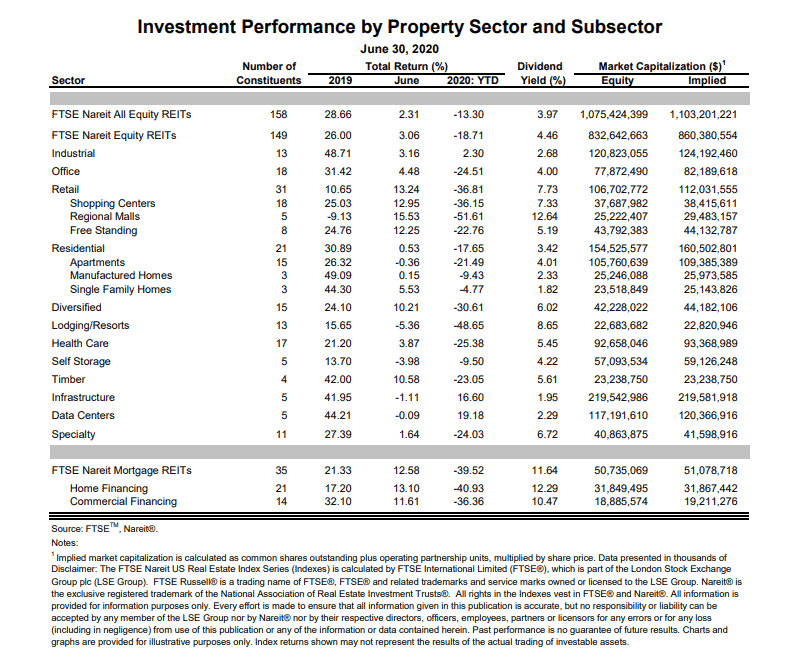

The performance of REIT sectors during the first half of 2020 varied significantly, as illustrated in Figure 1. Almost all sectors experienced negative returns, with lodging and retail REITs suffering the most substantial losses. Conversely, infrastructure, data center, and industrial REITs demonstrated positive gains, highlighting their resilience in the face of the pandemic. Diversified REITs, encompassing a broader range of property types, showed a significant decline of -30.61%.

In terms of dividend yields, retail and lodging REITs offered the highest returns. However, these high yields come with a caveat: elevated dividend risk, particularly in sectors heavily impacted by the pandemic.

REIT Sector Performance

REIT Sector Performance

Retail REITs face the critical challenge of maintaining occupancy rates as retailers are forced to close stores or operate at reduced capacity. In April 2020, retail rent collections plummeted by one-third. It is likely that collection rates have further declined since then. REITs with substantial cash reserves are better positioned to offer concessions such as temporary rent suspensions, lease extensions, or rent-percentage-of-sales agreements until economic conditions improve. These measures are crucial for securing future cash flows and ensuring longer-term occupancy.

Dividend Pressures and Adjustments

REITs, along with mutual funds and exchange-traded funds, operate under a regulatory framework that mandates the distribution of at least 90% of their taxable income to investors as dividends to maintain their pass-through status and avoid corporate taxation. Simultaneously, these entities must maintain sufficient cash reserves to navigate periods of economic instability.

This creates a delicate balancing act for REITs: fulfilling dividend obligations while conserving cash. Typically, when REITs encounter significant revenue pressures, they respond by cutting costs and potentially selling off assets. Reduced income inevitably leads to decreased dividends, which in turn can depress share prices. REITs with no taxable income are likely to suspend dividend payments altogether.

Dividend cuts are particularly impactful for fixed-income investors who are drawn to REITs for their regular payouts. Such reductions can disrupt income expectations, potentially leading risk-averse investors to sell their shares at a loss. Similarly, financially weaker REITs might be compelled to liquidate properties at unfavorable prices. Therefore, significant capital gains from REIT investments are less probable during the COVID-19 pandemic.

Liquidity Concerns and Debt

Equity REITs often finance property acquisitions and development through debt. The decline in rental income during the pandemic elevates the risk of defaults on these debt obligations. In severe cases, this can lead to foreclosure, financial reorganization, or even bankruptcy.

Mortgage REITs are vulnerable to disruptions in borrower payments. When mortgage holders can no longer meet their payment obligations, mortgage REITs may be forced to foreclose on properties, resulting in the acquisition of non-performing assets with diminished market value. Alternatively, they might attempt to sell non-performing mortgages, typically at a substantial discount to their book value, realizing significant losses in either scenario.

REITs as Lenders and Asset Compliance

Regulations stipulate that REITs must allocate at least 75% of their asset value to real estate, cash, cash equivalents, and government-backed securities. Interest earned from low-risk, short-term instruments like CDs and money market accounts qualifies as “good” assets for this 75% test. However, riskier assets like repos, banker’s acceptances, and certain debt holdings are excluded. A challenge arises when the value of real estate assets declines significantly, potentially causing a REIT to fall below the 75% threshold. In such situations, the REIT may lack sufficient qualifying assets to meet the regulatory requirement. Failure to promptly rebalance the asset allocation could jeopardize the REIT’s tax-advantaged status.

Strategies for REITs During the COVID-19 Pandemic

To mitigate the financial strain of the pandemic, REITs are exploring strategies to reduce tax liabilities and bolster cash reserves.

Given the depressed share prices, REITs seeking additional capital are understandably hesitant to issue secondary equity offerings, which would further dilute existing shareholder value. Instead, many REITs are turning to debt financing to raise capital. This approach offers the added benefit of increasing tax deductions through higher interest expenses.

Dividends themselves are also tax-deductible at the REIT level, as they are passed through to investors tax-free. REITs that distribute 100% of their income as dividends effectively eliminate their taxable income. Furthermore, REITs can deduct dividends declared in the current year, even if they are paid out in subsequent years, providing an additional mechanism to reduce current-year tax obligations.

Another cash management strategy for REITs facing liquidity constraints is to postpone quarterly dividend payments until just before the end of the fiscal year, up to one month after year-end. This deferral is permissible under REIT tax regulations and does not compromise their tax status, provided they meet specific timing requirements.

Investor Due Diligence and Considerations

Value investors might view the pandemic-induced price declines as a long-term opportunity to acquire fundamentally sound REIT assets at attractive discounts. However, it is crucial to differentiate genuine value opportunities from value traps – REITs that cannot sustain their dividend distributions even after the economy recovers.

Investors who rely on consistent dividend income should exercise caution when considering REIT investments during this period. Dividend payouts may be reduced or restructured, potentially shifting from quarterly to annual distributions. For investors who depend on this income stream for living expenses or to fund other investments, these disruptions can be significant.

Therefore, investors must conduct heightened due diligence when evaluating REITs in the current environment. While some of the largest retail REITs entered the pandemic with substantial cash reserves, the ultimate financial impact of the coronavirus remains uncertain. Staying informed through up-to-date financial news and in-depth analysis is essential for navigating the complexities of REIT investing during the COVID-19 pandemic.

[1] https://www.calvert.com/impact.php?post=the-covid-19-opportunity-for-retail-reits-invest-in-tenants&sku=35811

[1] https://www.reit.com/sites/default/files/returns/prop.pdf