Have you been in a car accident in New York and feel lost in the maze of car insurance claims? New York’s no-fault insurance system can be particularly confusing, especially when you’re dealing with disputes about who was at fault or facing a low settlement offer from your own insurance provider. Our experienced team of New York car insurance lawyers is here to guide you, regardless of who was at fault, and to fight for the full compensation you rightfully deserve.

How a New York Car Insurance Attorney Can Assist You

Our dedicated New York car insurance attorneys are equipped to handle a broad spectrum of car insurance claims, including:

- Personal Injury Claims: If you’ve sustained injuries in a car accident in New York, understanding your rights under the no-fault system is crucial. We can help you navigate the process to ensure you receive fair compensation from your Personal Injury Protection (PIP) insurance. Furthermore, we will assess whether your injuries meet the “serious injury” threshold, allowing you to sue the at-fault driver for additional damages.

- Property Damage Claims: Damage to your vehicle after an accident can be a major headache. Our lawyers can act as your advocate when dealing with insurance companies to secure a settlement that adequately covers the repair or replacement costs of your damaged vehicle.

- Uninsured/Underinsured Motorist (UM/UIM) Claims: It’s distressing when the at-fault driver is uninsured or doesn’t have sufficient coverage to meet your needs. A UM/UIM lawyer can step in to help you file a claim with your own insurance company to recover the compensation you are entitled to.

- Denied or Delayed Claims: Facing a denied claim or unreasonable delays in processing your claim can be frustrating and financially stressful. Our attorneys are prepared to challenge unfair denials and delays, fighting for prompt and fair resolutions.

- Rental Car Reimbursement: Being without a car after an accident is disruptive. We can assist you in recovering the costs of a rental car while your vehicle is undergoing repairs or replacement following a covered accident.

- Hit-and-Run Accidents: Hit-and-run accidents add another layer of complexity. We can guide you through the claims process with your own insurance company and explore all available avenues for compensation.

Beyond these specific claim types, our skilled insurance dispute lawyers are committed to:

- Conducting thorough investigations into the accident to gather vital evidence to strengthen your case.

- Managing all communications with insurance companies on your behalf, relieving you of stressful interactions.

- Skillfully negotiating settlement offers to ensure they are fair and fully address your losses.

- Providing strong legal representation in court if litigation becomes necessary to protect your rights.

Don’t remain in doubt about whether you need legal assistance for your car insurance claim in New York. We firmly believe that consulting with our team for a free, no-obligation case evaluation is always a beneficial first step. We will carefully evaluate your unique situation and provide informed advice on the most effective course of action.

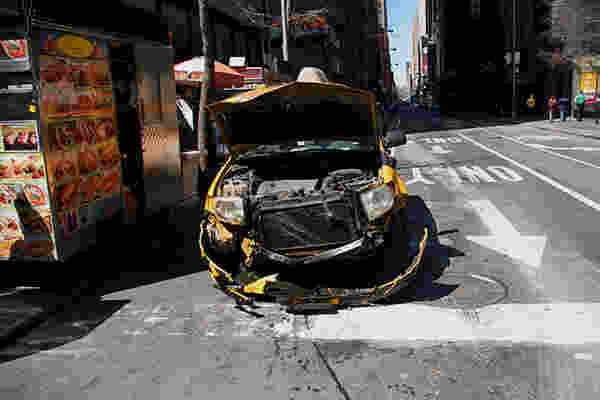

Car accident lawyer New York, insurance claim dispute attorney

Car accident lawyer New York, insurance claim dispute attorney

New York’s No-Fault Car Insurance System Explained

Yes, New York operates under a no-fault car insurance system. Following a car accident, regardless of who was at fault, you will typically file a claim with your own insurance company to cover your immediate medical expenses and other financial losses. This provision extends to you and any passengers covered under your policy, up to the limits of your Personal Injury Protection (PIP) coverage.

This system means that the at-fault driver’s insurance is generally not involved in covering your initial medical bills or lost wages unless your injuries meet New York State’s defined “serious injury” threshold.

Here’s a clearer breakdown of the no-fault system:

- No-Fault System: This system ensures that your immediate medical expenses, lost income, and other related losses are covered through your own Personal Injury Protection (PIP) coverage, irrespective of fault.

- Serious Injury Threshold: If your injuries are classified as “serious” under New York law, you gain the right to sue the at-fault driver and potentially recover additional compensation from their insurance company for damages beyond your PIP coverage.

What constitutes a “serious injury” in New York?

New York law defines a “serious injury” primarily in two ways:

- Permanent Limitation: Experiencing a permanent limitation of use of a body organ, member, function, or system.

- Significant Disfigurement: Suffering a significant limitation of a body function or system that results in a permanent and substantial cosmetic disfigurement.

- Medical Determination: These injuries must be formally diagnosed and documented by a qualified medical professional.

Examples of serious injuries can include:

- Bone fractures (depending on their severity and location)

- Loss of limbs or digits

- Permanent nerve damage

- Significant scarring or disfigurement

- Serious head injuries leading to lasting cognitive impairment

What happens if you meet the serious injury threshold?

If your injuries are deemed “serious,” you have the legal right to file a lawsuit against the driver who caused the accident. In such cases, their insurance company becomes responsible for covering damages beyond your PIP coverage, which may include:

- Compensation for pain and suffering

- Coverage for long-term medical care needs

- Reimbursement for lost future earnings

Even in a no-fault state like New York, consulting with our experienced car insurance and accident lawyers after a car accident is highly advisable, particularly if you have sustained serious injuries. Moreover, if an at-fault driver was operating within the scope of their employment for a company or corporation, there may be additional avenues for pursuing compensation. We are here to help you navigate the complexities of the no-fault system, determine if your injuries meet the serious injury threshold, and aggressively pursue the maximum compensation you are entitled to.

When Should You Seek a Lawyer for a Car Accident in New York?

Despite their reassuring slogans, insurance companies, including your own, are not primarily on your side after an accident. Their primary responsibility is to their shareholders, which often translates to minimizing payouts. Negotiating a settlement can be as challenging with your own insurance company as it is with the at-fault party’s insurer, especially in a no-fault state like New York. While we recommend consulting with a New York car insurance lawyer for any car accident case, here are specific situations where seeking advice from our expert insurance dispute lawyers is particularly crucial:

- Injuries: If you or anyone involved in the accident sustained injuries, it is imperative to consult with a lawyer. Our New York car insurance lawyers can guide you through the complexities of filing injury claims and work to secure fair compensation for medical expenses, lost wages, and pain and suffering.

- Significant Property Damage: While minor vehicle damage might not necessitate legal representation, extensive damage, especially when coupled with a low settlement offer from the insurance company, warrants consulting a lawyer to advocate for the full value of your vehicle.

- Disputes Over Fault: If there is disagreement or uncertainty about who was responsible for causing the accident, a lawyer can conduct a thorough investigation and gather evidence to build a strong case to establish fault. Although New York is a no-fault state, determining fault can be critical in maximizing your potential compensation, especially if serious injuries are involved.

- Insurance Issues: If your insurance company denies your claim, delays payments unreasonably, or makes an unfairly low settlement offer following a car accident, a lawyer can effectively fight for the compensation you are entitled to.

- Statute of Limitations Concerns: In New York, there is a three-year statute of limitations for filing a personal injury lawsuit related to a car accident. Consulting with a lawyer promptly after an accident ensures you have sufficient time to thoroughly investigate your case and file within the legal timeframe.

In any of these situations, we strongly advise scheduling a free consultation with our car accident lawyers. We can provide a detailed assessment of your specific case and advise you on the most appropriate course of action to protect your rights and interests.

New York Insurance Claim Settlement Timeframe

While New York law doesn’t specify an exact deadline for settling car insurance claims, it does set forth timeframes for insurance companies to adhere to at different stages of the claim process:

- 15 Business Days: Upon receiving your claim, the insurance company is mandated to acknowledge receipt and begin their investigation.

- Additional 15 Business Days (if necessary): The insurer is allowed an additional 15 business days to make a decision on your claim after completing their initial investigation, particularly if they require further information. They are required to provide a clear explanation if they need this extension.

Therefore, while there’s no fixed settlement deadline, an insurance company acting in good faith should typically aim to address your claim within 30 business days of receiving all necessary documentation. If the process extends beyond a reasonable timeframe, it could indicate unfair claims practices. Engaging an experienced insurance dispute lawyer like those at Cohen and Cohen can be instrumental in ensuring your claim is handled fairly and efficiently, and in securing a just settlement.

Responding to a Low Car Insurance Settlement Offer

If you’ve received a car insurance settlement offer that seems too low, the first step is: Call Us. As experienced New York car insurance lawyers, we frequently assist clients who are uncertain about how to proceed after receiving a settlement offer. The crucial point is to avoid rushing into accepting the offer. Take the necessary time to fully understand what the offer includes, what it covers, and how it compares to the full extent of your damages. This is where the guidance of a skilled legal team becomes invaluable. We can assess whether the offer is reasonable or undervalues your claim, and then negotiate effectively on your behalf.

If you haven’t yet consulted with a lawyer, there are important steps you can take to strengthen your position and prepare for when you do hire legal counsel. Meticulous documentation is key! Carefully compile all medical bills, records of lost wages due to time off work, car repair estimates, and any other expenses related to the accident. Also, consider and document potential future medical care or long-term income loss if your injuries are ongoing or permanent.

Once you have a comprehensive understanding of your total costs and liabilities, we can help you formulate a well-supported counteroffer. This revised offer should accurately reflect the true value of your damages, substantiated by evidence such as medical records, police reports, and detailed repair estimates, which we can assist you in gathering.

Remember, our primary goal is to fight for the full compensation you deserve from your insurance company, or, when applicable, from the at-fault party’s insurance provider. All insurance companies prioritize their financial bottom line, and their initial offers often significantly undervalue legitimate claims. By working together, we can strive to ensure you receive a fair settlement that truly reflects the full impact of the accident on your life. Don’t hesitate to contact us for a free case evaluation – let’s discuss your situation and begin the process of securing the compensation you are rightfully entitled to.

What To Do If Your Car Insurance Claim Is Denied

If your car insurance claim in New York is denied, we can work together on multiple fronts to challenge this decision. Here’s how we can assist you:

- In-Depth Review of the Denial: Our first step will be to thoroughly examine the denial letter from your insurance company. Understanding their specific reasons for denying your claim is essential. This analysis allows us to identify any weaknesses or misunderstandings in their explanation and develop a robust counter-argument.

- Gathering Evidence to Strengthen Your Case: We will collaborate with you to collect all necessary documentation that supports your claim. This may include the official police report, photographs from the accident scene, detailed repair estimates, all medical bills related to the accident, witness statements if available, and proof of vehicle ownership.

- Expert Handling of Appeals: Most insurance companies have an established internal appeals process. We will expertly guide you through this process, assisting you in drafting a compelling appeal letter. This letter will clearly articulate why you believe your claim should be covered, referencing specific terms within your insurance policy and demonstrating how the accident falls under your policy’s coverage.

- Strategic Negotiation with the Insurance Company: We will manage all further communication with the insurance company on your behalf. Our extensive experience in negotiating with insurance companies positions us to advocate persuasively for a favorable resolution to your case.

- Preparation for Litigation, If Necessary: If the appeal is unsuccessful, we are fully prepared to represent you in court and present your case before a judge. Our courtroom experience and litigation skills become a valuable asset in securing the compensation you deserve through legal action.

Throughout this entire process, our dedicated team of car accident attorneys in NYC will keep you fully informed and involved at every stage. We understand that dealing with a denied insurance claim can be incredibly frustrating and overwhelming. We are committed to fighting for your rights and ensuring you receive the insurance coverage you are entitled to under your policy.

Don’t let a car accident in New York leave you feeling confused and powerless. At Cohen and Cohen, our highly skilled team of New York car insurance lawyers and semi-truck accident attorneys are here to help you confidently navigate the complexities of car insurance claims and insurance claim disputes, regardless of fault. We are dedicated to fighting to ensure you receive fair and full compensation for your injuries, property damage, and all other related losses. Don’t accept a lowball offer or an unfair denial. Contact Cohen and Cohen today for a free, no-obligation consultation, and let us fight for what you rightfully deserve.

External Sources